Archive for the ‘Insurance’ Category

July 3, 2025

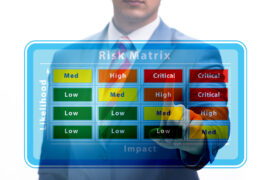

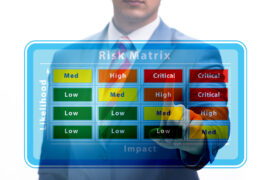

As global industries evolve, insurers face increasing challenges in underwriting emerging risks. Traditional risk assessment models struggle to keep pace with new threats, requiring insurers to adopt data-driven strategies, AI-powered analytics, and innovative policy structures. Below, we explore key emerging risks and the underwriting challenges associated with each.

Read more

June 19, 2025

Avoiding EEOC claims requires proactive measures to ensure compliance with anti-discrimination laws and foster a fair workplace.

Read more

June 5, 2025

Insurance law is built upon foundational principles that shape the way claims, disputes, and contracts are handled.

Read more

May 22, 2025

A recent U.S. Supreme Court ruling in Waetzig v. Halliburton Energy Services, Inc. has reinforced the importance of quick action for employers facing discrimination lawsuits.

Read more

May 8, 2025

Insurance fraud has long been a costly burden for the insurance industry, but in recent years, staged accidents have reached near-epidemic proportions.

Read more

April 17, 2025

A Difference in Conditions (DIC) policy covers risks excluded from standard property insurance policies. They fill gaps left by primary insurance, providing coverage for unpredictable and severe catastrophic events.

Read more

February 20, 2025

We often write about many of the policies that expand upon the coverage offered in a basic Commercial General Liability (CGL) policy. But what are the main features of the CGL coverage?

Read more

February 6, 2025

A Commercial General Liability (CGL) policy forms the foundation of a business’s insurance coverage by addressing basic third-party liability risks. However, businesses often face additional exposures that require specialized policies to expand upon the CGL’s protections.

Read more

January 23, 2025

Last spring, the Federal Emergency Management Agency (FEMA) issued a stern warning to southwest Florida communities still reeling from Hurricane Ian’s devastation in 2022.

Read more

January 9, 2025

“Along with the rising cost of living…, property insurance availability and affordability continue to be a challenge across the U.S.,” David A. Sampson, president and CEO of the American Property Casualty Insurance Association (APCIA), told Insurance Journal (November 26, 2024).

Read more