September 23, 2020

Get Ready for Parametric Insurance

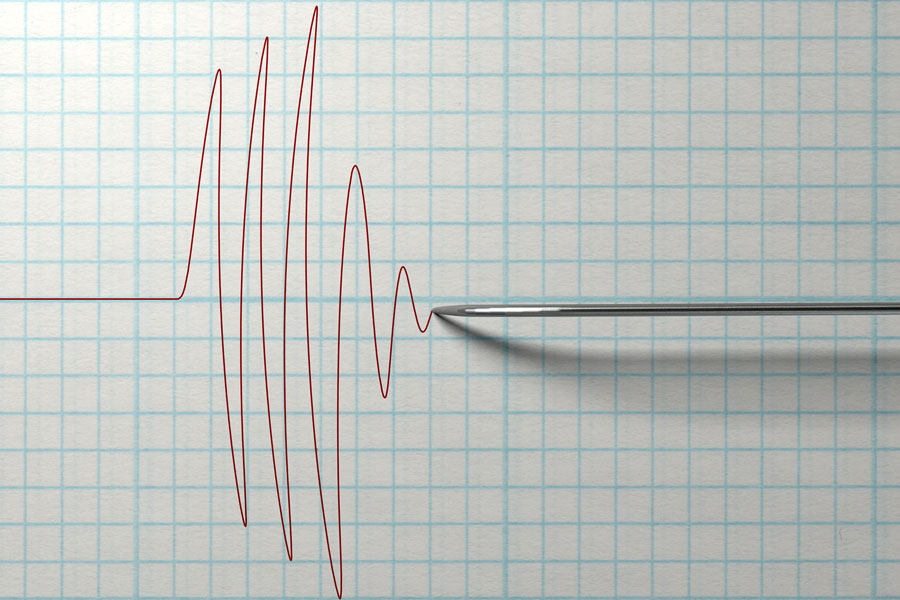

Parametric insurance is a type of insurance that does not indemnify the actual loss, but pays when something related has occurred with sufficient intensity to justify payment of a loss.

Imagine an insurance policy that pays policyholders not because of damage to their property but due to wind velocities reaching a certain level or an earthquake hitting at least 7.1 on the Richter Scale.

That’s how parametric insurance works. For instance, Swiss Re has just introduced an insurance product called FLOW that works on this principle. When water levels decline to a certain level in European rivers, the company pays out fixed amounts each day to its policyholders. This coverage is important for the shipping industry because ships can’t be loaded to full capacity when the waters are too shallow and there is not enough draft in them (distance from the waterline to bottom of the hull).

Another recent parametric insurance product is PathogenRX, created by risk modeling firm Metabiota, which protects against the economic impact of infectious disease outbreaks. It was developed to help industries that rely on people showing up, such as hotels and entertainment venues. If the product is triggered by an outbreak, data such as fatality counts are used to measure how much is paid out. It’s essentially a business income risk tool.

Insuring against business interruption is also the objective of what’s called non-damage business interruption (NDBI) insurance, which is designed to protect the income streams of companies like Uber or AirBNB against threats such as terrorism or bad weather that does not necessarily cause physical damage. STR Global also has a product that benchmarks hotel attendance and pays out when occupancy numbers drop below a certain level.

“The face of terrorism has changed,” said Joey Sylvester, regional director of specialty programs at Gallagher, in an interview with Risk Management magazine. “It is no longer about a building being blown up anymore, but rather people driving cars through crowds of pedestrians. Few of the buildings in the vicinity of the 2013 Boston Marathon bombing were directly damaged, but all the buildings had to shut down for a significant period.”

To cover future losses like that, the parametric insurance product Public Sector Terrorism Plus was created. It insures against acts of terrorism occurring anywhere within the borders of a public entity — or within a radius of 10, 25 or more miles — that cause a loss of tax revenue or extra expense. “If the attack occurs anywhere within the radius chosen by the insured, coverage is triggered. Capacity is provided by specialty insurers within Lloyd’s syndicates.”

As more data is collected about events and how people act, there could be an even greater variety of parametric insurance products. Insurance against reputation risk, for example, could be written based on measuring the amount of negative social media created against a business or person.

One of the problems associated with parametric insurance is finding trustworthy third parties whose data could be used to trigger a policy. One expert, Christopher Sheehan, CEO of WorldCover, pointed out to Risk Management that although The National Weather Service might be a good source of truth for measuring the impact of a hurricane in the U.S., finding a reliable third party to rely upon for measuring drought in Ghana could be more difficult.

The most obvious limitation for expanding parametric insurance at this point is lack of awareness. Even sophisticated risk managers require a lot of convincing. It’s also hard to see how it could be used outside of property and business interruption scenarios, as with casualty events. It’s also not necessarily any cheaper than a regular indemnity product.

It is, however, an interesting concept that we may see more of in the future. It certainly would have been a good coverage for many businesses to have during the pandemic.